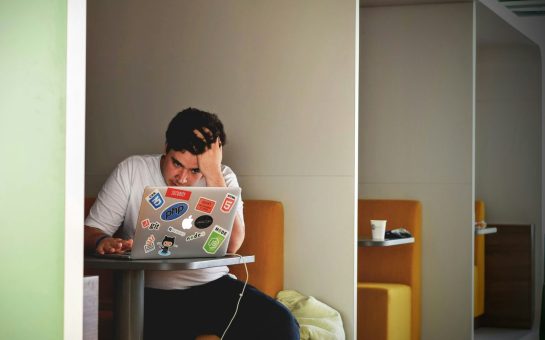

One in ten people in the North West worry about keeping up with their rent or mortgage payments following the Christmas splurge, according to new research.

The findings from Shelter and YouGov also reveal that 61% of people in the region are currently struggling with housing costs.

However, more than a quarter (27%) of people also admitted that they are too embarrassed to ask for assistance with their financial problems.

Nadeem Khan, Shelter’s helpline adviser, said: “Every day at Shelter we hear from people who are feeling overwhelmed by mounting rent or mortgage bills, as the increasing pressure of sky high housing costs continues to take its toll.

“I spoke to a lady recently who was sick with worry for months because she couldn’t meet her mortgage payments and felt too ashamed to ask for help. When finally a court notice landed on her doorstep she came to us and we were able to help the family keep their home”.

Mother-of-two Katharine works unpredictable shifts, so constantly worries about being able to meet her monthly payments.

She said: “I work every hour I can to support my family. But each month I wonder if I’m going to able to make my rent, and I’m expecting things to be especially bad Christmas, even though we cut back on spending as much as we could.

“I’ve borrowed money from family and even had to stop paying bills to keep the roof over my children’s heads. It’s horrible to start another year not knowing if I can afford to keep my home.”

Shelter’s top 5 tips to avoid eviction or repossession: –

1. Get expert advice – know your options

If you are struggling to pay your rent, talk to an expert adviser who can take you through your options and advise the next best steps for you. Visit Shelter’s official website here or call their free helpline on 0808 800 4444.

2. Make the mortgage or rent your priority

Paying your mortgage or rent should always be your number one priority. If you have other debts such as credit cards and phone bills you can take action to deal with these separately.

3. Respond to letters and phone calls

It’s natural to want to keep your head down and hope it’ll sort itself out but it’s important to read everything your mortgage lender, landlord or letting agent sends to you. Keep records of every letter and phone call.

4. Have a rainy day plan

It can take just one thing, like losing your job or falling ill, to put your home at risk. Avoid payday loans, as sky-high interest rates could make things much worse very quickly. There are usually much safer and cheaper alternatives.

5. Turn up for court hearings

If the worst comes to the worst, make sure you attend the possession hearing so that you can put your case to the judge. If you don’t have legal representation you can be assigned a court duty solicitor on the day – Shelter is one organisation that provides that service across the country. Get advice from an organisation like Shelter as soon as you get the hearing date to give yourself the best possible chance.

Image courtesy of TheTruthAbout, with thanks.